Understanding the Dynamics of Fake Transfers in Business

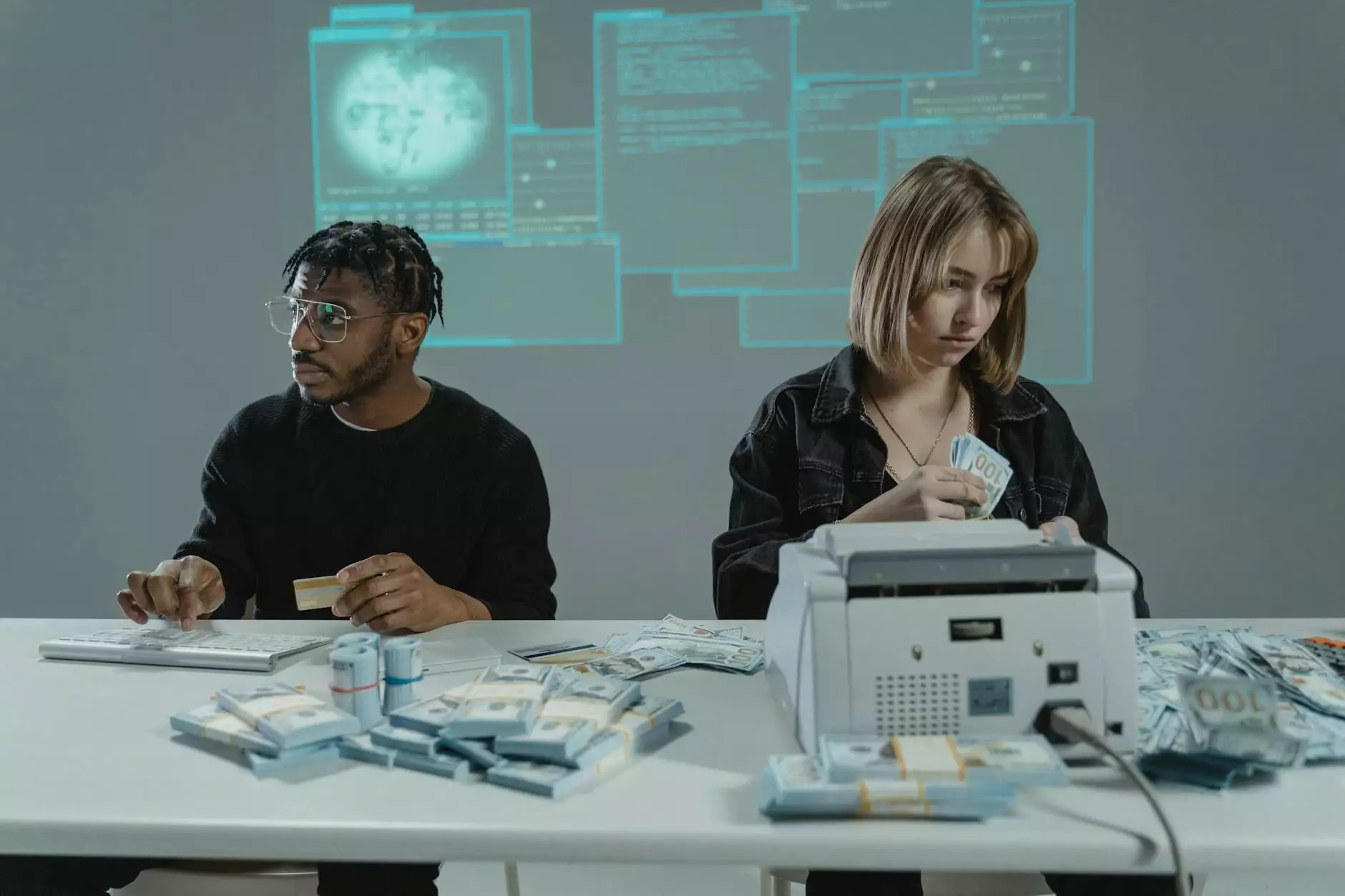

In today's rapidly evolving business environment, the concept of fake transfers has become increasingly prominent. This article aims to delve deeply into the phenomenon of fake transfers, unraveling its significance and implications, especially in industries dealing with fake banknotes, fake money, and counterfeit money. By understanding this subject, businesses can better protect themselves and navigate the complexities of modern commerce.

The Rise of Fake Transfers: A Modern Challenge

As globalization continues to expand business operations beyond borders, the manipulation of financial transactions has unfortunately become more prevalent. Fake transfers often involve the use of counterfeit currencies in various forms, affecting both businesses and consumers alike. But what exactly are fake transfers?

Defining Fake Transfers

At its core, a fake transfer refers to a deceitful transaction where the currency used is either counterfeit or non-existent. This illegal practice can take many forms, including:

- Fake banknotes mimicking legitimate currency.

- Online scams that trick individuals into believing they have received funds.

- Fraudulent wire transfers that utilize stolen identities or accounts.

Impact on Businesses

The repercussions of falling victim to fake transfers can be devastating for businesses. From financial loss to reputational damage, no company is immune from the threats posed by counterfeit financial exchanges.

Financial Loss

Perhaps the most immediate and severe consequence of fake transfers is financial loss. Businesses that accept counterfeit banknotes or engage in transactions that turn out to be fraudulent face the risk of:

- Revenue Loss: Directly losing anticipated income due to fake transactions.

- Increased Operational Costs: Spending on investigations, fraud detection, and legal fees.

- Insurance Complications: Difficulties in claiming losses with insurance providers.

Reputational Damage

In an increasingly interconnected world, reputation is everything. Businesses that are associated with fake money or fraudulent transfers may find themselves facing significant reputational risk. This can manifest in various ways:

- Loss of Customer Trust: Customers may be hesitant to engage with businesses that have a history of fraud.

- Negative Publicity: Media coverage of a company's involvement in fake transfers can tarnish its public image.

- Decreased Market Value: Stock prices may fall as investors react to the news of fraudulent activities.

Preventing Fake Transfers: Strategies for Businesses

To safeguard their interests against the growing threat of fake transfers, businesses must adopt comprehensive strategies. Here are some effective measures:

Implement Strong Verification Processes

Businesses should invest in robust verification systems to validate financial transactions. This can include:

- Utilizing specialized equipment to detect counterfeit banknotes.

- Requiring multiple forms of identification from clients.

- Employing secure payment gateways that verify transactions in real-time.

Training Employees

Regular training for employees is crucial to equip them with the knowledge needed to identify and respond to fake transfers. Key training topics include:

- Recognizing signs of counterfeit currency.

- Understanding the legal implications of accepting fake money.

- Implementing company policies regarding suspicious transactions.

Monitoring and Reporting Suspicious Activities

Encouraging a culture of vigilance can help in early detection of fake transfers. Businesses should:

- Establish Clear Reporting Channels: Employees must know how to report fraudulent activities.

- Conduct Regular Audits: Frequent internal audits can reveal discrepancies related to fake transfers.

- Collaborate with Law Enforcement: Building relationships with local authorities to combat fraud collaboratively.

Legal and Ethical Considerations

Beyond direct impacts on financial health, businesses must also consider the legal ramifications associated with fake transfers. Engaging in transactions that inadvertently involve counterfeit money can lead to legal challenges and severe penalties.

Understanding the Legal Risks

Companies involved in transactions with fake money could face serious consequences, including:

- Criminal charges against executives or employees.

- Fines and penalties imposed by regulatory bodies.

- Litigation from affected parties.

Maintaining Ethical Standards

Beyond the legalities, it is essential for businesses to uphold strong ethical standards. This includes:

- Taking proactive steps to combat counterfeit currency.

- Transparency in transactions to ensure integrity.

- Engaging with communities to educate them about financial fraud.

The Future of Transactions in Light of Fake Transfers

The reality of fake transfers has pushed many businesses to rethink their transaction methods. The future may hold innovations that protect against fraudulent activities, including:

Technological Advancements

The use of advanced technology will play a critical role in reducing the risk of fake transfers. Potential advancements include:

- Blockchain Technology: This could enhance transparency and traceability of transactions.

- Artificial Intelligence: AI-driven solutions may offer real-time fraud detection capabilities.

- Secure Digital Currencies: The rise of cryptocurrency could provide alternatives to traditional currency.

A Focus on Education and Awareness

As counterfeit methods become more sophisticated, ongoing education will be essential for businesses and consumers alike. This can include:

- Workshops and Seminars: Educating stakeholders about identifying fake money.

- Community Engagement: Partnering with local organizations to spread awareness.

- Collaboration with Financial Institutions: Working together to implement safer transaction practices.

Conclusion

In summary, the impact of fake transfers in the business realm cannot be overstated. As we have explored, they pose significant challenges that can lead to financial loss and damage to reputation. However, with proactive measures, including enhanced verification processes, employee training, and a commitment to ethical practices, businesses can mitigate these risks. By staying informed and adaptable in the face of evolving fraud tactics, companies will not only protect their operations but also ensure a more secure economic future for all stakeholders involved.

As you navigate this complex landscape, remember that knowledge is power. Equip yourself and your organization with the necessary tools and awareness to combat the threats posed by fake transfers effectively.

For more information on safeguarding your business against counterfeit issues, visit variablebills.com.